Corporate Governance

Our Corporate Governance

Basic Policy of Corporate Governance

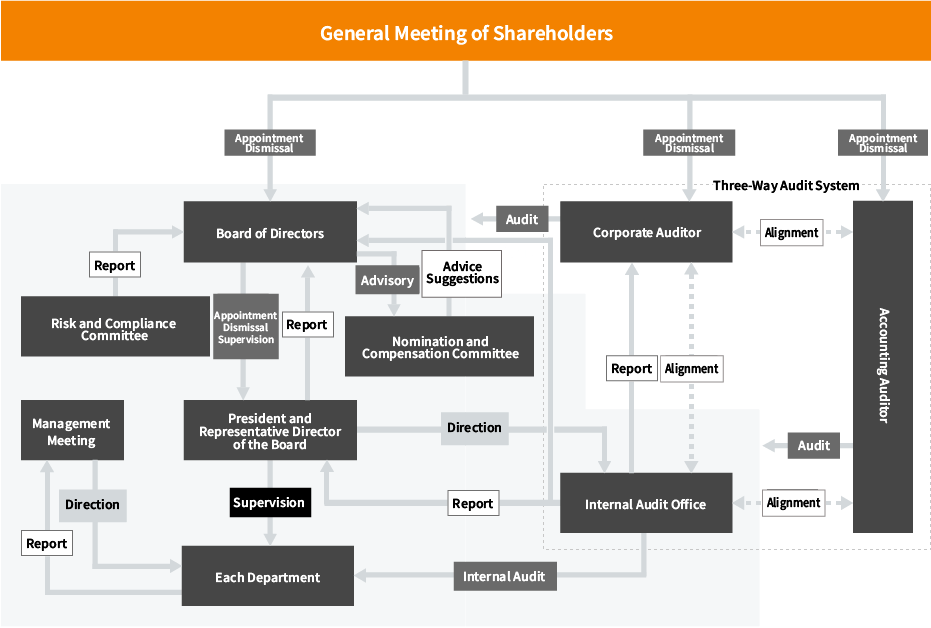

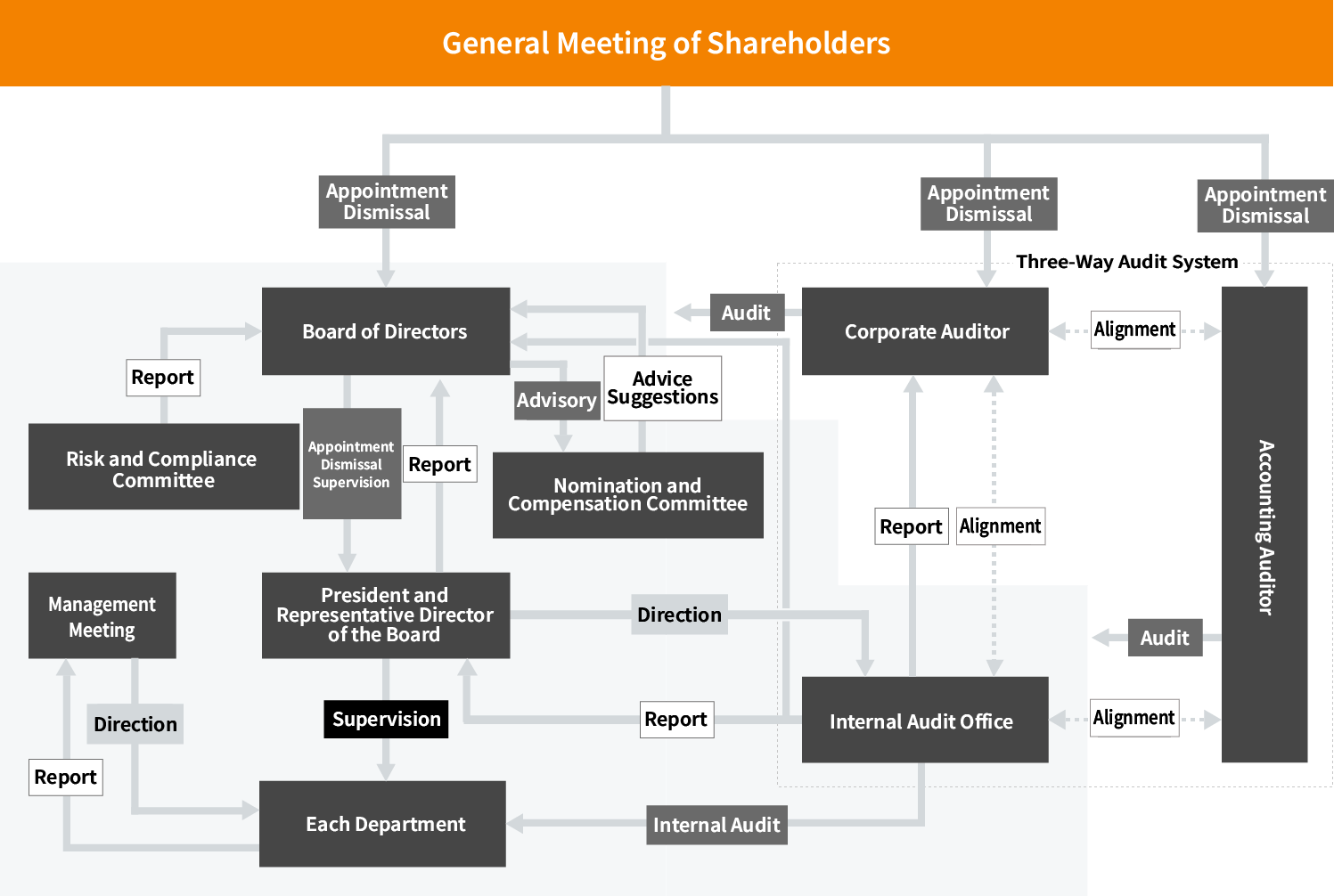

We are committed to improving the efficiency and speed of overall management and establishing a management organization that ensures legality, appropriateness, and transparency in decision-making and execution to promote the development of our business and enhance corporate value. Additionally, we strive to further strengthen internal systems for monitoring and corrective action.

Overview of Corporate Governance System and the Reason for Adopting the System

Overview of Corporate Governance System

Our corporate governance framework aims to promote transparent management. We have established a Board of Directors and Board of Corporate Auditers to conduct management oversight activities. In addition to these, we are enhancing our corporate governance structure by strengthening collaboration with the internal audit office which is under the direct control of the president.

-

Board of Directors

Our Board of Directors consists of six directors, including two outside directors. In addition to holding regular monthly meetings, we convene ad hoc board meetings as necessary to make important management decisions and deliberations as stipulated by laws and regulations. We also supervise the execution of duties by each director. Furthermore, we strengthen our management oversight function through advice and monitoring from external directors and external auditors who are independent of executive functions.

-

Board of Corporate Auditors

Our Board of Corporate Auditors consists of one full-time corporate auditor and two part-time corporate auditors (outside corporate auditors).The Audit Committee holds regular monthly meetings and convenes ad hoc meetings as necessary to discuss the annual audit plan, the execution of audit activities, and audit results, including the execution of duties of directors. Additionally, we strive to strengthen our management monitoring function from an independent standpoint, such as by sharing information and exchanging opinions with the internal audit department, accounting auditors, and outside directors. Each auditor attends the Board of Directors meetings to monitor our company's decision-making process and, when necessary, provides opinions, thereby strengthening a transparent and fair management oversight system. They also actively engage in effective monitoring activities, such as attending important meetings like management conferences and conducting inspections of various departments.

-

Internal Audit Office

Our internal audit office consists of one internal audit manager. Based on the internal audit plan, the department conducts internal audits of each department at least once a year to assess the rationality, efficiency, validity, propriety, and compliance of business operations. Following these audits, they provide recommendations for improvement to the heads of the audited departments and monitor the progress of improvements through follow-up audits.

-

Accounting Auditor

Our company has entered into an audit agreement with KPMG AZSA LLC, and appropriate audits are conducted in a timely manner.

-

Management Meeting

Our management meeting consists of four directors, two executive officers, a full-time corporate auditor, the head of the internal audit office, and the heads of each department. Outside directors and part-time corporate auditors may attend on a voluntary basis. In principle, the meeting is held once a month to discuss important matters and report on the business operations of each department.

-

Risk Compliance Committee

Our Risk and Compliance Committee is chaired by the President and Representative Director, and consists of three other directors and two executive officers. Outside directors and corporate auditors may attend at their discretion. In principle, the meeting is held once a quarter to discuss the development and operational status of the compliance system and internal audit system, consideration of matters that may pose risks in the future, and how to deal with them in the event of an occurrence.

-

Nomination and Compensation Committee

Our Nomination and Compensation Committee is chaired by an outside director, and also consists of the President and Representative Director and one outside director. In principle, it is held once a year to select and examine the qualifications of director candidates, confirm the status of execution of duties by directors and executive officers, and consider appropriate remuneration.

Reason for Adopting this System

We select directors and auditors who can express appropriate opinions on management, leveraging their respective expertise and experience. We prioritize the swift and sound execution of management strategies and the enhancement of robust corporate governance.

Our corporate governance structure is as follows.

Number of Directors

Our articles of incorporation stipulate that the number of directors shall be no more than 10.

Requirements for resolution for appointment of directors

Our Articles of Incorporation stipulate that the election of directors shall be made by a majority of the voting rights of the shareholders in attendance, with shareholders holding at least one-third of the voting rights of the shareholders who can exercise their voting rights at the general meeting of shareholders. Additionally, the articles of incorporation stipulates that the election of directors shall not be based on cumulative voting.

Special Resolution Requirements for General Meeting of Shareholders

We have stipulated in its Articles of Incorporation that resolutions pursuant to Article 309, Paragraph 2 of the Companies Act shall, except as otherwise provided in the Articles of Incorporation, require the presence of shareholders holding one-third or more of the voting rights exercisable at the general meeting of shareholders, and such resolutions shall be passed by a majority of two-thirds or more of the voting rights of the shareholders present at the meeting. This is intended to facilitate the smooth operation of the general meeting of shareholders.

Decision-making Body for Dividends of Surplus

We have stipulated in its articles of incorporation that matters related to the distribution of surplus funds, as provided for in Article 459, Paragraph 1 of the Companies Act, shall be determined by the resolution of the Board of Directors, except where otherwise provided by law, rather than by resolution of the general meeting of shareholders. This is intended to delegate the authority for the distribution of surplus funds to the Board of Directors, enabling flexible return of profits to shareholders.

Interim Dividends

We have stipulated in its articles of incorporation that, pursuant to the provisions of Article 454, Paragraph 5 of the Companies Act, the Board of Directors may decide to distribute interim dividends based on the reference date of December 31 each year. This is intended to enable flexible return of profits to shareholders.

Exemption from Liability for Directors and Corporate Auditors

In accordance with Article 426, Paragraph 1 of the Companies Act, we have stipulated in its articles of incorporation that the board of directors may resolve to exempt directors (including former directors) and auditors (including former auditors) from liability to the extent permitted by law under Article 423, Paragraph 1. This provision aims to create an environment in which directors and auditors can fully exercise their abilities and fulfill their expected roles while carrying out their duties.

Acquisition of Treasury Stock

In accordance with Article 165, Paragraph 2 of the Companies Act, we have stipulated in its articles of incorporation that we may acquire its own shares through a resolution of the board of directors. This provision aims to implement a flexible capital policy to respond to changes in the business environment.

Summary of the Contents of the Liability Limitation Agreement

We have entered into agreements with directors (excluding executive directors) and corporate auditors to limit liability for damages resulting from negligence in the performance of duties, based on the provisions of Article 427, Paragraph 1 of the Companies Act. However, the limit of liability under such agreements is set at the amount prescribed by law.

Summary of Contents of Officer Liability Insurance Contract

We plan to enter into a Directors' and Officers' Liability Insurance contract with an insurance company in accordance with Article 430-3, Paragraph 1 of the Companies Act. Under this insurance contract, if claims for damages are made against insured persons during the insurance period as a result of acts performed in their official capacity, the insurance will cover legal expenses and damages incurred by the insured persons. However, there are exclusions such as damages resulting from the insured person's illegal acquisition of private benefits or advantages, and damages resulting from acts performed by the insured person knowingly violating laws, for which coverage will not be provided. The insured persons under this insurance contract include the company's directors, auditors, and executive officers, who are not responsible for paying the insurance premiums.

Activities of the Board of Directors

The Board of Directors generally convenes once a month. During the current fiscal year, there have been 23 meetings held (including one written resolution deemed as a Board resolution). The specific matters deliberated during these Board meetings include the selection of the representative director, convening of the annual general meeting of shareholders, approval of the annual financial statements, approval of quarterly financial statements, budget formulation, decision-making on investments, and approval of the establishment or revision of regulations and policies.

Activities of the Nomination and Compensation Committee

The Nomination and Remuneration Committee typically convenes once a year. During the current fiscal year, it has been held four times. The specific matters deliberated during these committee meetings include the activities and performance of directors and executive officers, as well as discussions regarding their remuneration, appointment, and dismissal to ensure appropriateness.